Gold De

Gold Price Forecast for 2023: Insights from the LBMA Survey

Market Outlook and Expert Predictions

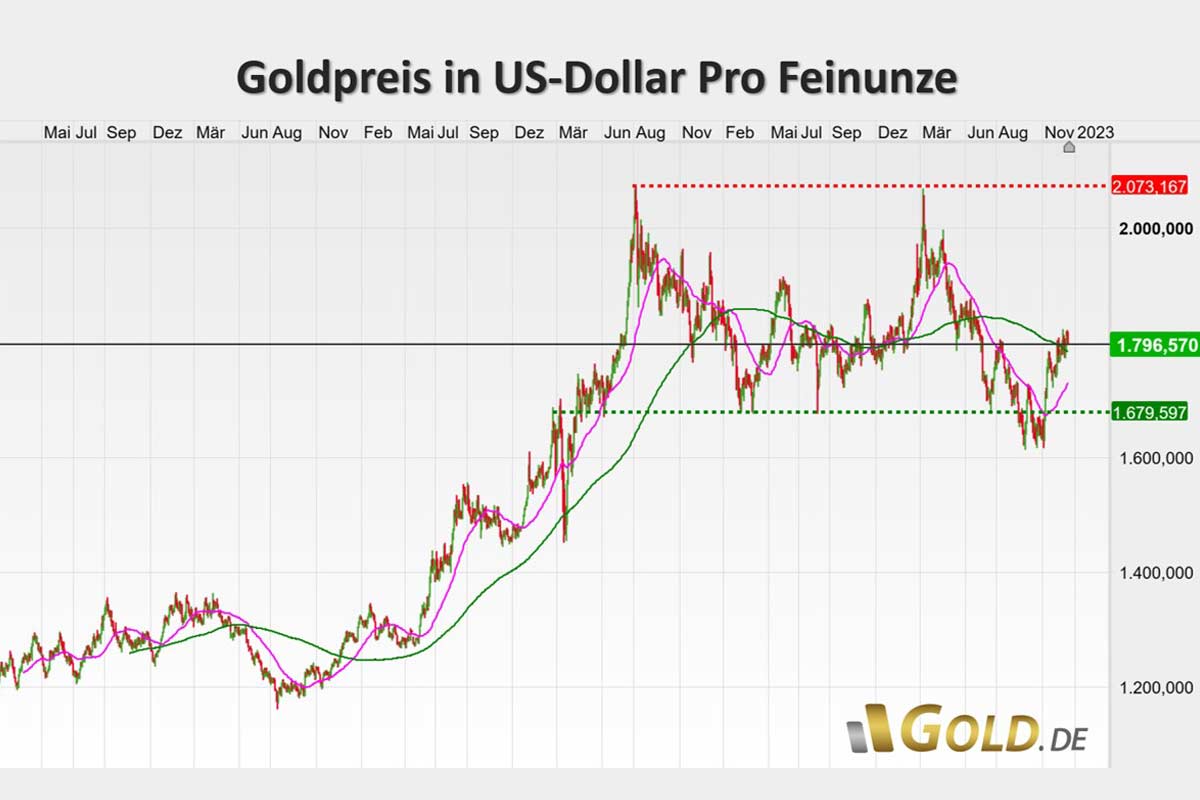

The London Bullion Market Association (LBMA) recently released the results of its annual Forecast Survey, providing insights into the anticipated performance of gold prices in 2023. According to the survey, participants generally expect a positive outlook for gold, with an average price prediction of $1,910 per troy ounce.

Factors Influencing Gold Prices

Several factors are driving the bullish sentiment surrounding gold. Concerns about global economic uncertainty, geopolitical tensions, and high inflation have increased demand for safe-haven assets like gold. Additionally, the US dollar's potential weakness and expectations of reduced interest rate hikes could further support gold prices.

Expert Perspectives

Michael Mesaric, Head of Metal Strategy at Bank of America, predicts gold may hit $2,100 per troy ounce in 2023, driven by geopolitical risks, inflation, and safe-haven flows. Meanwhile, Citigroup's head of commodities research, Ed Morse, foresees a more modest rise to $1,850 per troy ounce, citing a stronger US dollar and potential headwinds from central bank interest rate policies.

Investment Implications

The LBMA Forecast Survey highlights the potential for gold as a valuable asset in portfolios during periods of market volatility and economic uncertainty. Investors seeking diversification and a hedge against inflation should consider allocating a portion of their investments to gold.

Conclusion

The LBMA Forecast Survey provides valuable insights into the anticipated performance of gold prices in 2023. Experts predict a positive outlook, driven by safe-haven demand and economic uncertainties. Investors looking to hedge against risk and capitalize on market volatility may want to consider incorporating gold into their portfolios.

Gold De

Comments